We’ve got all the tech that the big banks have — but with a more personal touch.

Setting Up NSF Alerts

Turning Off Your Debit Card

Raising Your Spending Limits

Making P2P Payments

Bank anywhere you have internet access — 24/7. If you have a Synergy Bank account, you can easily sign up for online banking today. You will be prompted to enter your personal information, answer some questions from your credit history, establish your security questions, and set up your username and passwords.

Online Banking

- Manage bank accounts from your own computer1

- Free, secure, and easy-to-use service for Synergy Bank customers

- Manage a number of banking activities anytime, anywhere with internet access:

- Access electronic statements

- View account balances and history

- Transfer funds between accounts (one-time and recurring transfers)

- View checks written

- Make loan payments

- And more

- Make more time for yourself; fewer bank trips necessary

- Set up your Personal Financial Management System

- Encrypted service to keep information secure

You can also manage your debit card through online banking. Learn more.

How to Make an External Transfer

You can transfer money between your Synergy Bank account and accounts you own at other financial institutions.

To set up your external account transfers, please follow these easy steps:

- Sign into online banking. Click the 'Move money' on the left sidebar, then click the 'New Transaction' on the right of the page.

- You will be prompted to select which account you are moving the money from and then you will need to add 'a new payee'. You will need to select the external account.

- You will need to enter the account name, account number, and routing number. For security, you will have to verify that you are the account owner of those accounts.

How to Send Person-to-Person Payments

Synergy’s P2P payments are easy, convenient and free. See our tutorial on how to send P2P payments (PDF).

How to Set Up Account Alerts

Account alerts are a great way to manage your account and protect against fraud. You can receive alerts via email and/or text message. In order to receive alerts via text message, you must add your device to your online banking profile and turn on SMS text alerts for that device.

See a tutorial on adding a device to your online banking profile and turning on text alerts (PDF).

There are several account alerts you can receive via email and/or text message. See a tutorial on managing account alerts (PDF).

Bill Pay

- Free service available to all online banking users

- Pay one-time or recurring bills with ease:

- Schedule payments in advance

- Set up automatic recurring payments

- Set up payment reminders

- Have all payee information in one convenient place

- Reduce paper waste

- Save on postage fees

1In order to access online banking, your computer should have one of the following supported browsers and operating systems:

- Operating Systems Certified: Windows 7, Windows 8; Supported: Windows 10, Windows Vista, Mac OS 10.7 and above

- Browsers Certified: Internet Explorer 9-11 (32-bit); Supported: Internet Explorer 9-11 (64-bit), Edge Browser, Mozilla Firefox (Current Version), Google Chrome (Current Version), Apple Safari 6+ (Mac OS Only)

- eStatements: Adobe Acrobat Reader Version 7.0 minimum required.

Bank on the go, anytime, for free. Get started by downloading our app for your iPhone®, iPad®, or Android™ device.

Mobile Banking

- Fast, free, and secure service for Synergy Bank customers1

- Easily keep track of your finances on the go:

- Check account balances

- View recent transactions

- Transfer funds between accounts

- Receive alerts

- Pay bills

- Deposit checks

- And more

- Available via any web-enabled cell phone or mobile device

- Utilize this service in three convenient ways:

- Save valuable time and effort; avoid an extra trip to a branch

You can also manage your debit card through online banking. Learn more.

How to Use Text Banking

Text banking allows you access to your account at Synergy Bank through your mobile phone by simply texting a code to 662265.

In order to use text banking, you must activate the service through online banking. See this PDF tutorial to learn how to activate our text banking service.

Text one of these codes to 662265 to receive information about your account on your phone.

Codes to text and what they mean:

BAL – Balance

ACT – Account Activity

HELP – General Help

STOP – Stop this service

CMD – Will give you a list of the available commands

Mobile Deposit

- Deposit checks wherever you are

- Free services available through our mobile banking app1

- Easy to use — almost as simple as sending a photo

- Encrypted for your security, even if your phone is lost or stolen

How to Use Mobile Deposit

Mobile deposit is available in the free Synergy Bank mobile app for Apple® and Android devices.2

- Download our mobile app.

- Ensure that the check is made payable to you, the account holder.

- Important: On the back of the check, include the following: “Mobile Deposit to Synergy Bank”, endorsement (signature) and the account number. For optimal image quality, use black ink.

- Open up Synergy Bank's mobile app and log in.

- Select the Deposits tab and follow the prompts on your screen.

We recommend that you keep the check at least 5 calendar days from the date the check has posted to your account.

Checks received for deposit are subject to the provisions of the Uniform Commercial Code or any applicable collection agreement. All items received are subject to conditions and terms stated in the Mobile Deposit Disclosure and Funds Availability Policy provided on your account. Checks deposited after 6:00 p.m. (CDT) will be processed on the following banking day. Some deposits may not be available for immediate withdrawal.

1Wireless carrier fees may apply. Enrollment not available on all devices. Check your wireless carrier agreement for details. To access Mobile Banking, you must enroll in Synergy Bank's Online Banking.

2Apple, the Apple logo, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc.

Save money and reduce paper clutter with free eStatements. They contain the same information as paper statements.

- Save paper and save the environment

- Fast, free, and easy alternative to paper statements

- Easier to retrieve info when needed

- Eliminate a paper trail

- Reduce chances of fraud and identity theft

- Arrive faster than paper statements

- Simplify recordkeeping

- Easily access past statements

- Ability to download for permanent storage or print if needed

- Receive email notice when new eStatement is ready

Setting up eStatements

See a tutorial on how to set up eStatements (PDF).

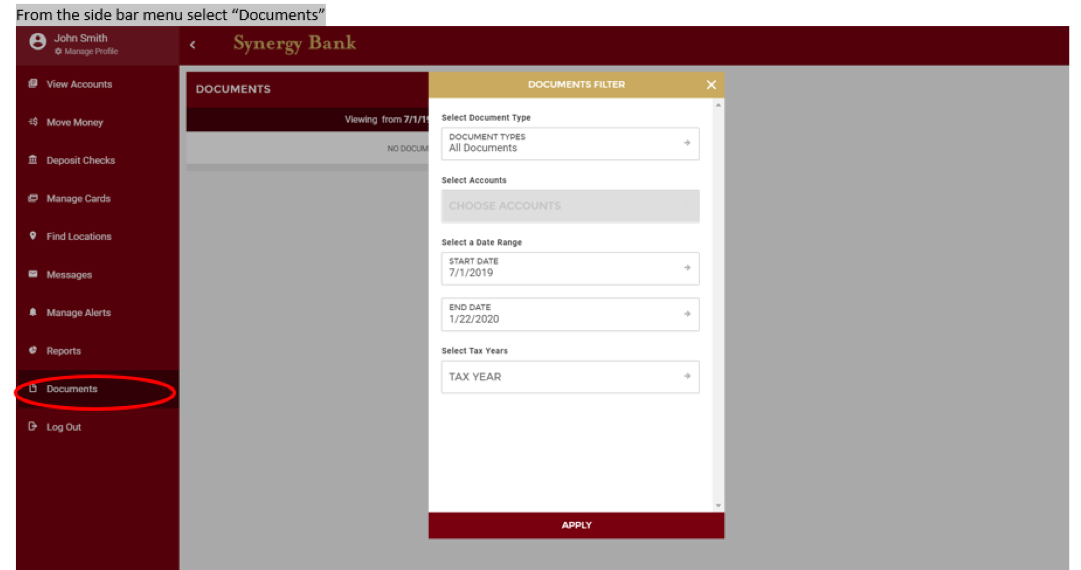

Accessing eStatements

Your statements are found on the ‘Documents’ tab. Select ‘Document Types’ from the pop-up window. Select ‘Statements.’ Select the date range for the statements you want to view. Click ‘Apply.’

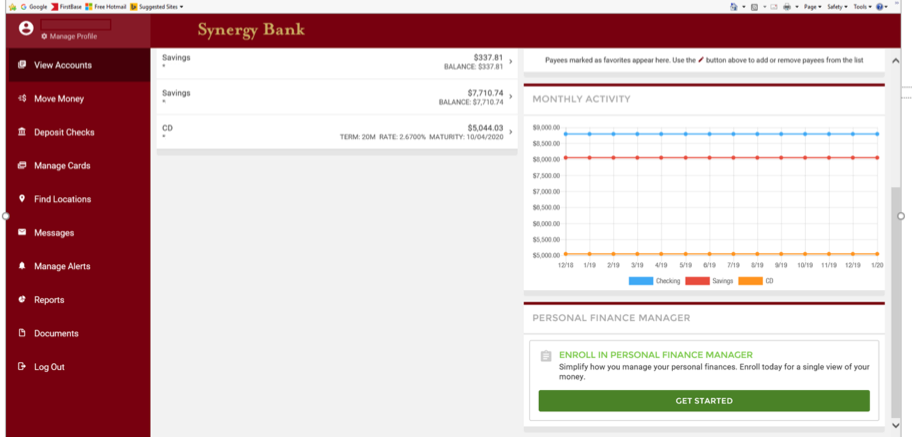

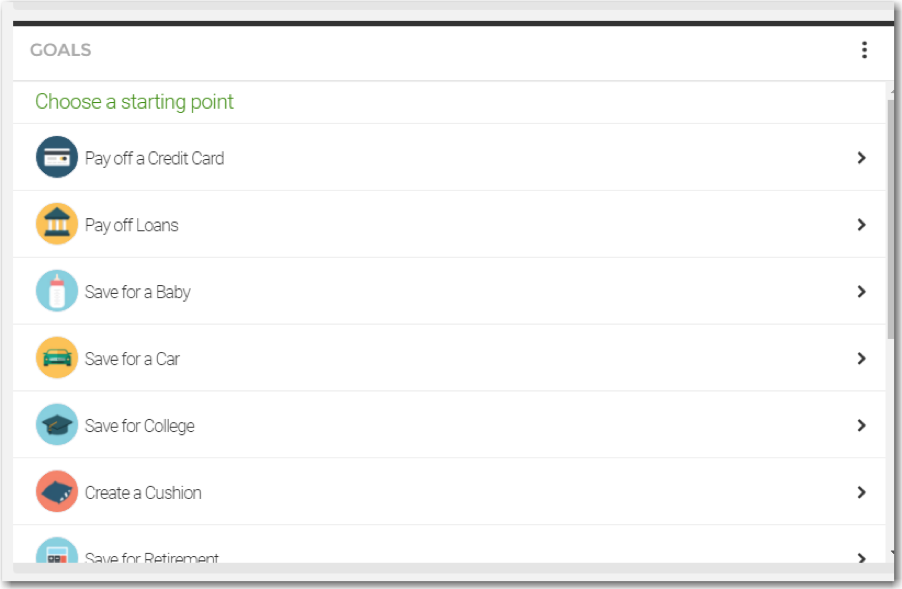

A great new feature of Synergy Online Banking is the Personal Financial Management System. This can be found at the bottom right of online banking.

You can manage your financial data with tools to help track expenses and goal progress all through online banking.

You can add your credit cards and other financial institutions to help you track your progress toward your goals that you’ve set.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc. 1Google Pay is a trademark of Google LLC. Google Pay works on Android devices running Android Lollipop 5.0 or above. Samsung Pay is a trademark of Samsung Electronics Co., Ltd. Use only in accordance with law. Contact your bank or financial institution to verify that it is a Samsung Pay participant. Samsung Pay is available on select Samsung devices. The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.